This is the dirty little secret that liberal media and politicians do not want you to know. They try very hard to sell us on the idea that the rich make too much money, and by raising taxes on them, the economy will grow.

As a matter of absolute fact, and proved out by Nobel Prize winning economist Milton Friedman, the opposite is true.

First and foremost, only the poor pay any taxes at all. Every time you raise taxes on anyone, those costs are put into the "cost of living", and they get passed down to those below in the form of higher prices. Even if you are a humble employee, when taxes go up you need to get a raise or your standard of living goes down. When the employer GIVES those raises, he, too, must pass the cost along in the form of higher prices - prices that we ALL pay, which again increases the cost of living, requiring yet another round of raises. Bear in mind - only the poor, who have no one below them to pass increased costs onto - only they will actually pay the taxes. ALL of the taxes. Their Ramen soup, which had been 25 cents is now 30 cents. There is truth in "The rich get richer and the poor get poorer", but it is not necessarily the fault of the rich. It is usually the fault of increased taxes.

Now I would ask you to put yourself in the position of the "rich" fellow. You are the CEO of a multi-million (or billion) dollar business. Your top three priorities (leaving out God for the moment) are 1) yourself, 2) your family, and 3) your stockholders. Keep that in mind while we move forward here.

Uncle Sam decides to raise your taxes. What do you do? If you are deserving of your CEO position, you will do one or more of the following if you want to keep providing for your family, and keep your job:

- You would raise prices on your goods and services, to cover the increase in the cost of doing business (taxes)

- You would lay off employees to cut costs

- You would freeze wages

The economy, without question or doubt, will shrink. Everyone suffers, but the poor will suffer the most. And all because the government increased taxes (cost of doing business) on the very people we look to for production of goods and services, and the addition of jobs and paying of salaries.

When we were children, most of us heard the story of the Golden Goose. And we learned what happens when you kill the Golden Goose - no more golden eggs. Raising taxes on the rich is akin to starving the goose.

You see, the rich actually NEED more money (and often deserve it) because unlike you and I, who are responsible only for our families, they are often responsible for the survival of many families. Can you imagine how many people - families - rely upon Bill Gates of Microsoft? As Sean Hannity says, "I never got a job from a poor person."

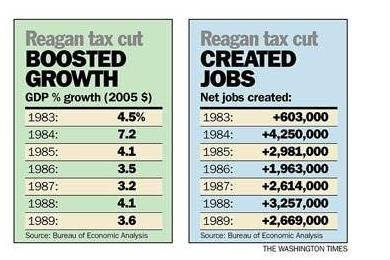

Liberal progressives would counter, "But if you cut taxes on the rich, they'll get richer." True enough - but so will everyone else. When you cut taxes on the rich, they don't just blow it on bubble gum and candy. They did not get rich by being stupid. No, they will reinvest that money into more production, more employees, in order to create more profit. And it is those investments that produce jobs, raise wages and kick-starts the economy.

I am not saying we should feel sorry for the rich if taxes get raised. But I AM saying we should feel sorry for OURSELVES if taxes get raised on the rich, because we would all pay.